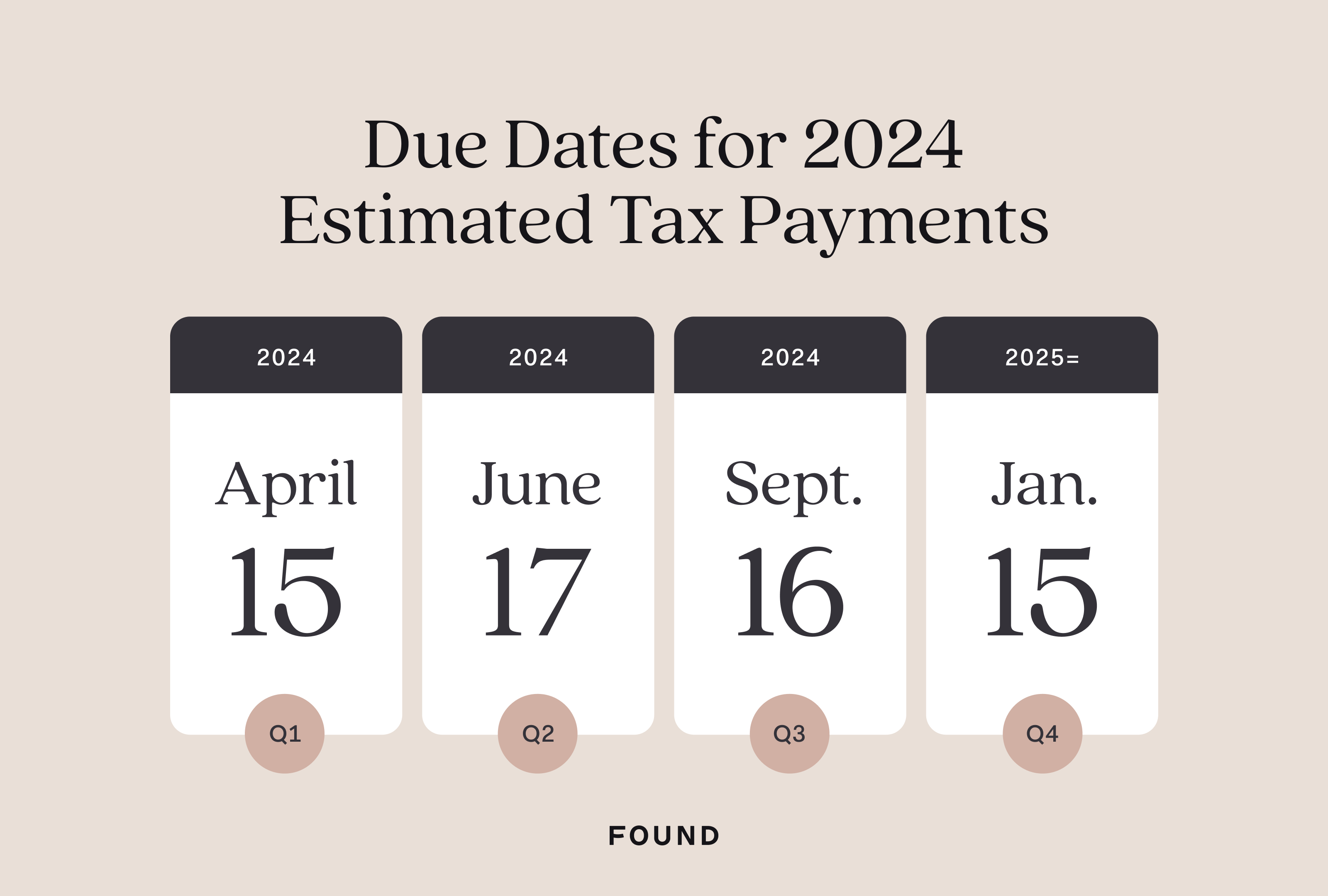

Estimated Tax Payments Calendar – It is a time when one thinks about filing their income tax return (ITR). However, as a compliance due date in the Income Tax calendar, 15 June is significant for the previous and current fiscal years. . We present our “Money Calendar” series. Check out our list of notable June 17 is the deadline for estimated tax payments Your tax return for the 2024 tax year is due by April 2025, so this is the .

Estimated Tax Payments Calendar

Source : www.kitces.com

Find Out The Penalty For Not Making Quarterly Tax Payments

Source : flyfin.tax

When Are Estimated Tax Payments Due in 2024? | Miller Cooper

Source : millercooper.com

Found on X: “Don’t let those estimated tax payments sneak up on

Source : twitter.com

How Do I Know if I Need to Pay Quarterly Taxes? — Delta Wealth

Source : deltawealthadvisors.com

Estimated taxes | Internal Revenue Service

Source : www.irs.gov

What to Do if You File Taxes Late or Miss The Tax Deadline

Source : found.com

How to Pay Estimated Taxes / How to Pay Estimated Taxes

Source : www.collective.com

IRS Reminder: 2024 Q1 Estimated Tax Payment Due by April 15

Source : insightfulaccountant.com

IRS Issues Reminder for Estimated Tax Payment Deadline Taxing

Source : www.drakesoftware.com

Estimated Tax Payments Calendar Reducing Estimated Tax Penalties With IRA Distributions: These laws make sure that individuals and businesses pay their fair share of taxes and maintain social security programs. Keeping track of the deadlines for different files and payments is essential . . 13-Jun-24 GSTR 5 All the non-resident persons must file the GSTR-5 alongside the payment about tax compliance, please don’t hesitate to contact us at +91-8788550677, or connect with us on LinkedIn .