Short Calendar Spread With Calls – A short call butterfly spread is executed by shorting/selling 1 high strike ITM call, 1 low strike call OTM, and buying 2 long mid-strike ATM calls. For example, if we wanted to execute a short . The short call spread (or “bear call spread”) is a strategy In this scenario, both of your calls would expire worthless, and the entire net credit of 0.39, or $39, would be yours to keep. .

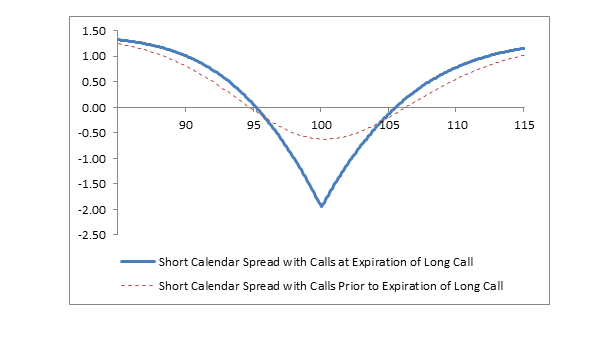

Short Calendar Spread With Calls

Source : www.fidelity.com

Short Calendar Call Spread | Learn Options Trading

Source : marketchameleon.com

Short Call Calendar Spread (Short Call Time Spread)

Source : www.optionseducation.org

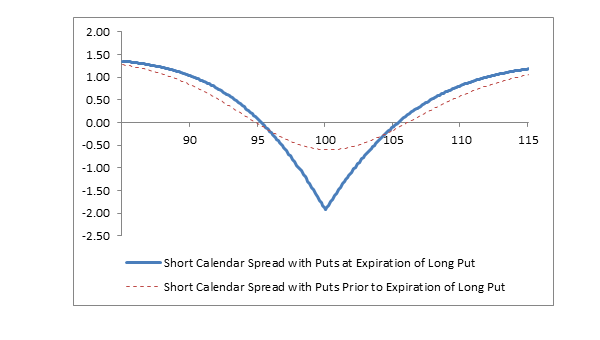

Short Calendar Spread with Puts Fidelity

Source : www.fidelity.com

Calendar Spreads in Futures and Options Trading Explained

Source : www.investopedia.com

Short Calendar Spread Option Samurai Blog

Source : blog.optionsamurai.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

Calendar Spread Options Option Samurai Blog

Source : blog.optionsamurai.com

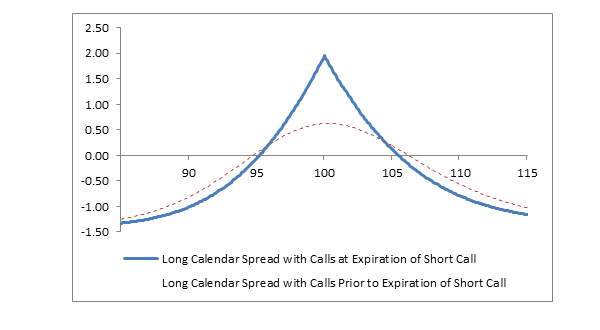

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

Calendar Call: Definition, Purpose, Advantages, and Disadvantages

Source : www.strike.money

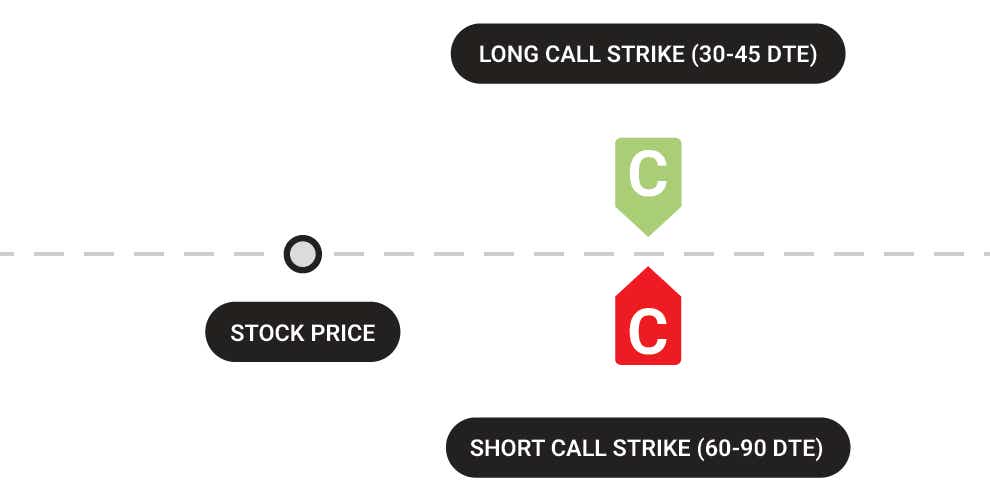

Short Calendar Spread With Calls Short Calendar Spread with Calls Fidelity: The long call calendar spread is engineered if the stock plummets sharply, both calls can be left to expire worthless. Since you’re simultaneously long and short two call options at the . Calendar spreads are an option trade that involves selling a short-term option and buying a longer-term option with the same strike. Traders can use calls or up a calendar spread at $175 .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)